ATTENTION

This book will covers the essential steps every S-Corp owner needs to manage their business effectively, from tax filings to paying yourself a reasonable salary. By mastering these processes, you'll avoid penalties, reduce your tax burden, and maximize the benefits of your

S-Corp, allowing you to focus on growth and long-term success.

CLICK BELOW TO WATCH FIRST!

Unlock Tax Savings and Financial Freedom with The S-Corp Playbook!

Understanding the annual responsibilities of an S-Corp owner is crucial for staying compliant with tax laws, optimizing financial health, and avoiding costly penalties. In this comprehensive book and training, you'll learn step-by-step how to handle everything from filing your tax returns to paying yourself a reasonable salary, ensuring that you maximize the benefits of your S-Corp. Whether you're a new business owner or an experienced entrepreneur, mastering these essential processes will save you time, reduce your tax burden, and set you up for long-term success. This course is designed to give you the tools and confidence you need to efficiently manage your S-Corp, protect your business, and focus on growth.

About

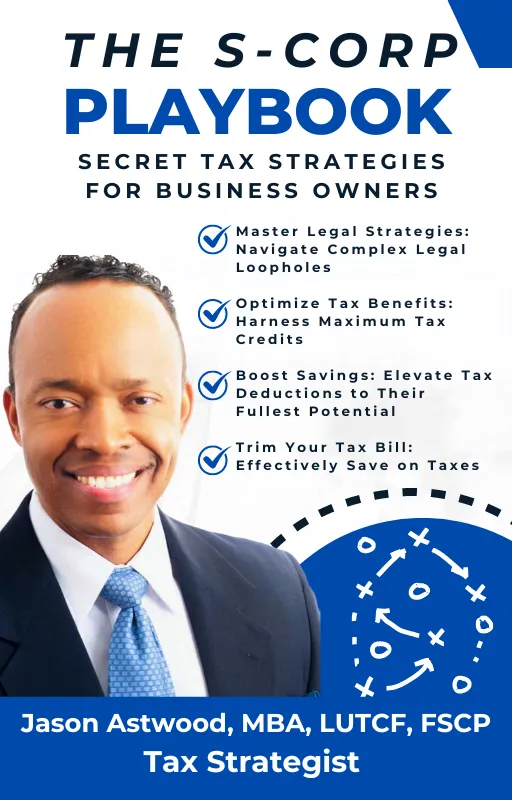

Jason Astwood

As the Director of Union National Tax and the author of 'The S-Corp Playbook,' Jason is a seasoned financial and tax expert dedicated to assisting businesses. With extensive experience in financial planning and tax strategies, Jason specializes in optimizing financial health, managing cash flow, ensuring compliance, and offering personalized tax advice. His expertise contributes significantly to the business success and growth of many companies UNT works with.

Client Testimonials